During the 1990s, investors marveled at the nature of its software business. The company spent tens of millions of dollars to develop each of its digital delivery and storage software programs. But thanks to the internet, Inktomi’s software could be distributed to customers at almost no cost.

Method One: Best for Your Own Business

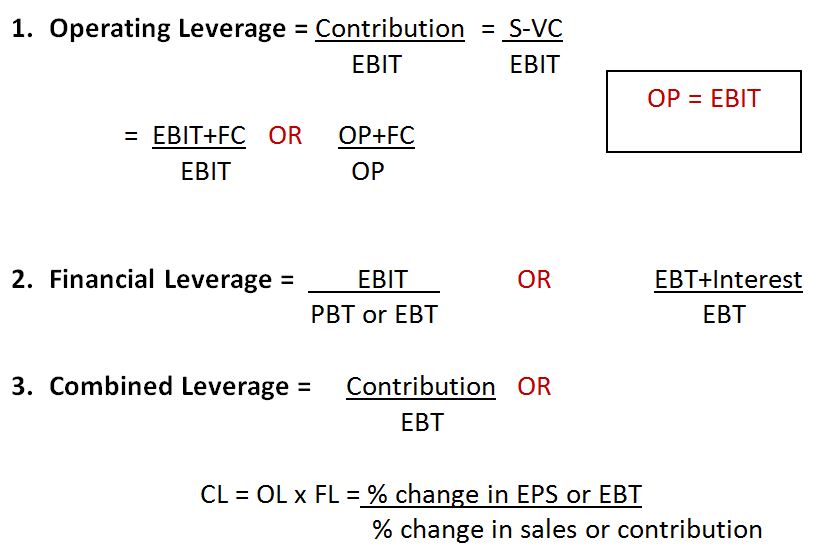

In other words, most of your costs go into producing the actual product. This is often viewed as less risky since you have fewer fixed costs that need to be covered. With the operating leverage formula in hand, a company can see how different kinds of expenses impact their operating income. This ratio summarizes the effects of combining financial and operating leverage, and what effect this combination, or variations of this combination, has on the corporation’s earnings. Not all corporations use both operating and financial leverage, but this formula can be used if they do.

Operating Leverage Made Easy: Formula and Examples

The Federal Reserve created guidelines for bank holding companies, although these restrictions vary depending on the rating assigned to the bank. In general, banks that experience rapid growth or face operational or financial difficulties are required to maintain higher leverage ratios. Operating margins tell investors how efficiently the company creates profits from the business operations. In good times, high operating leverage companies can supercharge earnings. Still, companies with costs tied up in machinery, plants, real estate, and networks can’t easily move on a dime and cut expenses.

Operating Leverage Formula

This is the financial use of the ratio, but it can be extended to managerial decision-making. Managers use operating leverage to calculate a firm’s breakeven point and estimate the effectiveness of pricing structure. An effective pricing structure can lead to higher economic gains because the firm can essentially control demand by offering a better product at a lower price. If the firm generates adequate sales volumes, fixed costs are covered, thereby leading to a profit.

- Also, the operating leverage metric is useless in some industries because it fluctuates too much or cannot be reasonably calculated based on public information.

- It simply indicates that variable costs are the majority of the costs a business pays.

- On the other hand, a low DOL suggests that the company has a low proportion of fixed operating costs compared to its variable operating costs.

- Companies with a low DOL have a higher proportion of variable costs that depend on the number of unit sales for the specific period while having fewer fixed costs each month.

Degree of operating leverage formula

Increasing utilization infers increased production and sales; thus, variable costs should rise. If fixed costs remain the same, a firm will have high operating leverage while operating at a higher capacity. The bulk of this company’s cost structure is fixed and limited to upfront development and marketing costs. Whether it sells one copy or 10 million copies of its latest Windows software, Microsoft’s costs remain basically unchanged. So, once the company has sold enough copies to cover its fixed costs, every additional dollar of sales revenue drops into the bottom line.

Ask a Financial Professional Any Question

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. These two costs are conditional on past demand volume patterns (and future expectations).

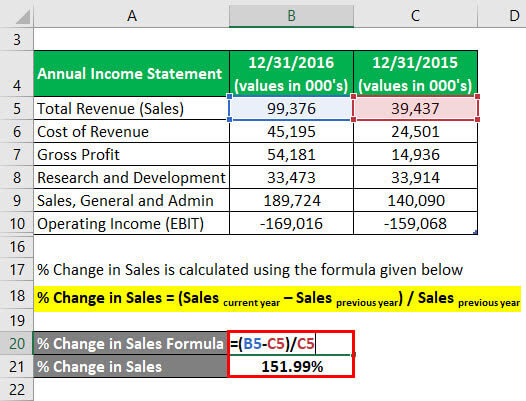

Specifically, DOL is the percentage change in income (usually taken as earnings before interest and tax, or EBIT) divided by the percentage change in the level of sales output. In fact, operating leverage occurs when a firm has fixed taxpayer definition and meaning costs that need to be met regardless of the change in sales volume. Under all three cases, the contribution margin remains constant at 90% because the variable costs increase (and decrease) based on the change in the units sold.

Instead, the decisive factor of whether a company should pursue a high or low degree of operating leverage (DOL) structure comes down to the risk tolerance of the investor or operator. Next, if the case toggle is set to “Upside”, we can see that revenue is growing 10% each year and from Year 1 to Year 5, and the company’s operating margin expands from 40.0% to 55.8%. Just like the 1st example we had for a company with high DOL, we can see the benefits of DOL from the margin expansion of 15.8% throughout the forecast period. In the final section, we’ll go through an example projection of a company with a high fixed cost structure and calculate the DOL using the 1st formula from earlier. If sales and customer demand turned out lower than anticipated, a high DOL company could end up in financial ruin over the long run.